Monday, February 27, 2012

Saturday, February 25, 2012

Thursday, February 23, 2012

Wednesday, February 22, 2012

Dow Hits 13,000, a Mark Last Reached in 2008

The Dow Jones industrial average broke through 13,000 on Tuesday, attaining an intraday level not seen since before the financial crisis in 2008.

The index, which tracks the stocks of 30 large companies, had wavered in early trading. But at 11:24 Eastern time, on a day marked by news of an agreement in Europe over a bailout package for Greece, the index briefly pushed through to 13,000.64. Within minutes it fell back below the mark.

Tuesday, February 21, 2012

Friday, February 17, 2012

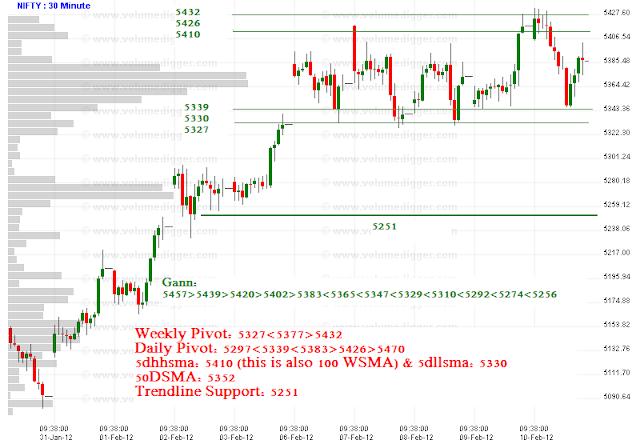

Gann is clear winner

Gann is clear winner whenever it comes to predict Nifty in up move or down move and we do not have clear vision about the target. For the last one and a half month, Nifty is continuously making higher move. I have noticed Gann has predicted exact target of upmove when no technical level is present there and also if there is no clear resistance is visible. I left this to you, to judge how effectively we can use the same for our benefits.

Thursday, February 16, 2012

Wednesday, February 15, 2012

Tuesday, February 14, 2012

Open Interest to determine trend

Open interest is an indicator often used by traders to confirm trends and trend reversals for both the futures and options markets. Open interest represents the total number of open contracts on a security. Here we'll take a look at the importance of the relationship between volume and open interest in confirming trends and their impending changes. (Check out an introduction to the concept of open interest in Intro To Open Interest In The Futures Market.)

General Rules for Volume and Open Interest

The chart below summarize the rules for volume and open interest.

So, price action increasing in an uptrend and open interest on the rise is interpreted as new money coming into the market (reflecting new buyers); this is considered bullish. Now, if the price action is rising and the open interest is on the decline, short sellers covering their positions are causing the rally. Money is therefore leaving the marketplace; this is a bearish sign.

General Rules for Volume and Open Interest

The chart below summarize the rules for volume and open interest.

|

| Figure 1: General rules for volume and open interest |

So, price action increasing in an uptrend and open interest on the rise is interpreted as new money coming into the market (reflecting new buyers); this is considered bullish. Now, if the price action is rising and the open interest is on the decline, short sellers covering their positions are causing the rally. Money is therefore leaving the marketplace; this is a bearish sign.

|

| Figure 2: Bullish and bearish signs according to open interest |

Monday, February 13, 2012

Sunday, February 12, 2012

Warren Buffett Biography

Warren Edward Buffett was born on August 30, 1930 to his father Howard, a stockbroker-turned-Congressman. The only boy, he was the second of three children, and displayed an amazing aptitude for both money and business at a very early age. Acquaintances recount his uncanny ability to calculate columns of numbers off the top of his head - a feat Warren still amazes business colleagues with today.

At only six years old, Buffett purchased 6-packs of Coca Cola from his grandfather's grocery store for twenty five cents and resold each of the bottles for a nickel, pocketing a five cent profit. While other children his age were playing hopscotch and jacks, Warren was making money. Five years later, Buffett took his step into the world of high finance. At eleven years old, he purchased three shares of Cities Service Preferred at $38 per share for both himself and his older sister, Doris. Shortly after buying the stock, it fell to just over $27 per share. A frightened but resilient Warren held his shares until they rebounded to $40. He promptly sold them - a mistake he would soon come to regret. Cities Service shot up to $200. The experience taught him one of the basic lessons of investing: patience is a virtue.

Warren Buffett's Education

In 1947, a seventeen year old Warren Buffett graduated from High School. It was never his intention to go to college; he had already made $5,000 delivering newspapers (this is equal to $42,610.81 in 2000). His father had other plans, and urged his son to attend the Wharton Business School at the University of Pennsylvania. Buffett stayed two years, complaining that he knew more than his professors. When Howard was defeated in the 1948 Congressional race, Warren returned home to Omaha and transferred to the University of Nebraska-Lincoln. Working full-time, he managed to graduate in only three years.

Warren Buffett approached graduate studies with the same resistance he displayed a few years earlier. He was finally persuaded to apply to Harvard Business School, which, in the worst admission decision in history, rejected him as "too young". Slighted, Warren applied to Columbia where famed investors Ben Graham and David Dodd taught - an experience that would forever change his life.

Ben Graham - Buffett's Mentor

Ben Graham had become well known during the 1920's. At a time when the rest of the world was approaching the investment arena as a giant game of roulette, he searched for stocks that were so inexpensive they were almost completely devoid of risk. One of his best known calls was the Northern Pipe Line, an oil transportation company managed by the Rockefellers. The stock was trading at $65 a share, but after studying the balance sheet, Graham realized that the company had bond holdings worth $95 for every share. The value investor tried to convince management to sell the portfolio, but they refused. Shortly thereafter, he waged a proxy war and secured a spot on the Board of Directors. The company sold its bonds and paid a dividend in the amount of $70 per share.

When he was 40 years old, Ben Graham published Security Analysis, one of the greatest works ever penned on the stock market. At the time, it was risky; investing in equities had become a joke (the Dow Jones had fallen from 381.17 to 41.22 over the course of three to four short years following the crash of 1929). It was around this time that Graham came up with the principle of "intrinsic" business value - a measure of a business's true worth that was completely and totally independent of the stock price. Using intrinsic value, investors could decide what a company was worth and make investment decisions accordingly. His subsequent book, The Intelligent Investor, which Warren celebrates as "the greatest book on investing ever written", introduced the world to Mr. Market - the best investment analogy in history.

Through his simple yet profound investment principles, Ben Graham became an idyllic figure to the twenty-one year old Warren Buffett. Reading an old edition of Who's Who, Warren discovered his mentor was the Chairman of a small, unknown insurance company named GEICO. He hopped a train to Washington D.C. one Saturday morning to find the headquarters. When he got there, the doors were locked. Not to be stopped, Buffett relentlessly pounded on the door until a janitor came to open it for him. He asked if there was anyone in the building. As luck (or fate) would have it, there was. It turns out that there was a man still working on the sixth floor. Warren was escorted up to meet him and immediately began asking him questions about the company and its business practices; a conversation that stretched on for four hours. The man was none other than Lorimer Davidson, the Financial Vice President. The experience would be something that stayed with Buffett for the rest of his life. He eventually acquired the entire GEICO company through his corporation, Berkshire Hathaway.

Flying through his graduate studies at Columbia, Warren Buffett was the only student ever to earn an A+ in one of Graham's classes. Disappointingly. both Ben Graham and Warren's father advised him not to work on Wall Street after he graduated. Absolutely determined, Buffett offered to work for the Graham partnership for free. Ben turned him down. He preferred to hold his spots for Jews who were not hired at Gentile firms at the time. Warren was crushed.

Warren Buffett Returns Home

Returning home, he took a job at his father's brokerage house and began seeing a girl by the name of Susie Thompson. The relationship eventually turned serious and in April of 1952 the two were married. They rented out a three-room apartment for $65 a month; it was run-down and served as home to several mice. It was here their daughter, also named Susie, was born. In order to save money, they made a bed for her in a dresser drawer.

During these initial years, Warren's investments were predominately limited to a Texaco station and some real estate, but neither were successful. It was also during this time he began teaching night classes at the University of Omaha (something that wouldn't have been possible several months before. In an effort to conquer his intense fear of public speaking, Warren took a course by Dale Carnegie). Thankfully, things changed. Ben Graham called one day, inviting the young stockbroker to come to work for him. Warren was finally given the opportunity he had long awaited.

Warren Buffett Goes to Work for Ben Graham

The couple took a house in the suburbs of New York. Buffett spent his days analyzing S&P reports, searching for investment opportunities. It was during this time that the difference between the Graham and Buffett philosophies began to emerge. Warren became interested in how a company worked - what made it superior to competitors. Ben simply wanted numbers whereas Warren was predominately interested in a company's management as a major factor when deciding to invest, Graham looked only at the balance sheet and income statement; he could care less about corporate leadership. Between 1950 and 1956, Warren built his personal capital up to $140,000 from a mere $9,800. With this war chest, he set his sights back on Omaha and began planning his next move.

On May 1, 1956, Warren Buffett rounded up seven limited partners which included his Sister Doris and Aunt Alice, raising $105,000 in the process. He put in $100 himself, officially creating the Buffett Associates, Ltd. Before the end of the year, he was managing around $300,000 in capital. Small, to say the least, but he had much bigger plans for that pool of money. He purchased a house for $31,500, affectionately nicknamed "Buffett's Folly", and managed his partnerships originally from the bedroom, and later, a small office. By this time, his life had begun to take shape; he had three children, a beautiful wife, and a very successful business.

Over the course of the next five years, the Buffett partnerships racked up an impressive 251.0% profit, while the Dow was up only 74.3%. A somewhat-celebrity in his hometown, Warren never gave stock tips despite constant requests from friends and strangers alike. By 1962, the partnership had capital in excess of $7.2 million, of which a cool $1 million was Buffett's personal stake (he didn't charge a fee for the partnership - rather Warren was entitled to 1/4 of the profits above 4%). He also had more than 90 limited partners across the United States. In one decisive move, he melded the partnerships into a single entity called "Buffett Partnerships Ltd.", upped the minimum investment to $100,000, and opened an office in Kiewit Plaza on Farnam street.

In 1962, a man by the name of Charlie Munger moved back to his childhood home of Omaha from California. Though somewhat snobbish, Munger was brilliant in every sense of the word. He had attended Harvard Law School without a Bachelor's Degree. Introduced by mutual friends, Buffett and Charlie were immediately drawn together, providing the roots for a friendship and business collaboration that would last for the next forty years.

Ten years after its founding, the Buffett Partnership assets were up more than 1,156% compared to the Dow's 122.9%. Acting as lord over assets that had ballooned to $44 million dollars, Warren and Susie's personal stake was $6,849,936. Mr. Buffett, as they say, had arrived.

Wisely enough, just as his persona of success was beginning to be firmly established, Warren Buffett closed the partnership to new accounts. The Vietnam war raged full force on the other side of the world and the stock market was being driven up by those who hadn't been around during the depression. All while voicing his concern for rising stock prices, the partnership pulled its biggest coup in 1968, recording a 59.0% gain in value, catapulting to over $104 million in assets.

The next year, Warren went much further than closing the fund to new accounts; he liquidated the partnership. In May 1969, he informed his partners that he was "unable to find any bargains in the current market". Buffett spent the remainder of the year liquidating the portfolio, with the exception of two companies - Berkshire and Diversified Retailing. The shares of Berkshire were distributed among the partners with a letter from Warren informing them that he would, in some capacity, be involved in the business, but was under no obligation to them in the future. Warren was clear in his intention to hold onto his own stake in the company (he owned 29% of the Berkshire Hathaway stock) but his intentions weren't revealed.

Warren Buffett Gains Control of Berkshire Hathaway

Buffett's role at Berkshire Hathaway had actually been somewhat defined years earlier. On May 10, 1965, after accumulating 49% of the common stock, Warren named himself Director. Terrible management had run the company nearly into the ground, and he was certain with a bit of tweaking, it could be run better. Immediately Mr. Buffett made Ken Chace President of the company, giving him complete autonomy over the organization. Although he refused to award stock options on the basis that it was unfair to shareholders, Warren agreed to cosign a loan for $18,000 for his new President to purchase 1,000 shares of the company's stock.

Two years later, in 1967, Warren asked National Indemnity's founder and controlling shareholder Jack Ringwalt to his office. Asked what he thought the company was worth, Ringwalt told Buffett at least $50 per share, a $17 premium above its then-trading price of $33. Warren offered to buy the whole company on the spot - a move that cost him $8.6 million dollars. That same year, Berkshire paid out a dividend of 10 cents on its outstanding stock. It never happened again; Warren said he "must have been in the bathroom when the dividend was declared".

In 1970, Buffett named himself Chairman of the Board of Berkshire Hathaway and for the first time, wrote the letter to the shareholders (Ken Chace had been responsible for the task in the past). That same year, the Chairman's capital allocation began to display his prudence; textile profits were a pitiful $45,000, while insurance and banking each brought in $2.1 and $2.6 million dollars. The paltry cash brought in from the struggling looms in New Bedford, Massachusetts had provided the stream of capital necessary to start building Berkshire.

A year or so later, Warren Buffett was offered the chance to buy a company by the name of See's Candy. The gourmet chocolate maker sold its own brand of candies to its customers at a premium to regular confectionary treats. The balance sheet reflected what Californians already knew - they were more than willing to pay a bit "extra" for the special "See's" taste. The businessman decided Berkshire would be willing to purchase the company for $25 million in cash. See's owners were holding out for $30 million, but soon conceded. It was the biggest investment Berkshire or Buffett had ever made.

Following several investments and an SEC investigation (after causing a merger to fail, Warren and Munger offered to buy the stock of Wesco, the target company, at the inflated price simply because they thought it was "the right thing to do". Not surprisingly, the government didn't believe them), Buffett began to see Berkshire's net worth climb. From 1965 to 1975, the company's book value rose from $20 per share to around $95. It was also during this period that Warren made his final purchases of Berkshire stock (when the partnership dolled out the shares, he owned 29%. Years later, he had invested more than $15.4 million dollars into the company at an average cost of $32.45 per share). This brought his ownership to over 43% of the stock with Susie holding another 3%. His entire fortune was placed into Berkshire. With no personal holdings, the company had become his sole investment vehicle.

In 1976, Buffett once again became involved with GEICO. The company had recently reported amazingly high losses and its stock was pummeled down to $2 per share. Warren wisely realized that the basic business was still in tact; most of the problem were caused by an inept management. Over the next few years, Berkshire built up its position in this ailing insurer and reaped millions in profits. Benjamin Graham, who still held his fortune in the company, died in in September of the same year, shortly before the turnaround. Years later, the insurance giant would become a fully owned subsidiary of Berkshire.

It was shortly thereafter one of the most profound and upsetting events in Buffett's life took place. At forty-five, Susan Buffett left her husband - in form. Although she remained married to Warren, the humanitarian / singer secured an apartment in San Francisco and, insisting she wanted to live on her own, moved there. Warren was absolutely devastated; throughout his life, Susie had been "the sunshine and rain in my [his] garden". The two remained close, speaking every day, taking their annual two-week New York trip, and meeting the kids at their California Beach house for Christmas get-togethers. The transition was hard for the businessman, but he eventually grew somewhat accustomed to the new arrangement. Susie called several women in the Omaha area and insisted they go to dinner and a movie with her husband; eventually, she set Warren up with Astrid Menks, a waitress. Within the year, she moved in with Buffett, all with Susie's blessing.

Warren Buffett Wants Two Nickels to Rub Together

By the late '70s, the his reputation had grown to the point that the rumor Warren Buffett was buying a stock was enough to shoot its price up 10%. Berkshire Hathaway's stock was trading at more than $290 a share, and Buffett's personal wealth was almost $140 million. The irony was that Warren never sold a single share of his company, meaning his entire available cash was the $50,000 salary he received. During this time, he made a comment to a broker, "Everything I got is tied up in Berkshire. I'd like a few nickels outside."

This prompted Warren to start investing for his personal life. According to Roger Lowenstein's "Buffett", Warren was far more speculative with his own investments. At one point he bought copper futures which was unadulterated speculation. In a short time, he had made $3 million dollars. When prompted to invest in real estate by a friend, he responded "Why should I buy real estate when the stock market is so easy?"

Berkshire Hathaway Announces Charitable Giving Program

Later, Buffett once again showed his tendency of bucking the popular trend. In 1981, the decade of greed, Berkshire announced a new charity plan which was thought up by Munger and approved by Warren. The plan called for each shareholder to designate charities which would receive $2 for each Berkshire share the stockholder owned. This was in response to a common practice on Wall Street of the CEO choosing who received the company's hand-outs (often they would go to the executive's schools, churches, and organizations). The plan was a huge success and over the years the amount was upped for each share. Eventually, the Berkshire shareholders were giving millions of dollars away each year, all to their own causes. The program was eventually discontinued after associates at one of Berkshire's subsidiaries, The Pampered Chef, experienced discrimination because of the controversal pro-choice charities Buffett chose to allocate his pro-rated portion of the charitable contribution pool. Another important event around this time was the stock price which hit $750 per share in 1982. Most of the gains could be attributed to Berkshire's stock portfolio which was now valued at over $1.3 billion dollars.

Warren Buffett Buys Nebraska Furniture Mart, Scott Fetzer and an Airplane for Berkshire Hathaway

For all the fine businesses Berkshire had managed collect, one of the best was about to come under its stable. In 1983, Warren Buffett walked into Nebraska Furniture Mart, the multi-million dollar furniture retailer built from scratch by Rose Blumpkin. Speaking to Mrs. B, as local residents called her, Buffett asked if she would be interested in selling the store to Berkshire Hathaway. Blumpkin's answer was a simple "yes", to which she responded she would part for "$60 million". The deal was sealed on a handshake and one page contract was drawn up. The Russian-born immigrant merely folded the check without looking at it when she received it days later.

Scott & Fetzer was another great addition to the Berkshire family. The company itself had been the target of a hostile takeover when an LPO was launched by Ralph Schey, the Chairman. The year was 1984 and Ivan Boesky soon launched a counter offer for $60 a share (the original tender offer stood at $50 a share - $5 above market value). The maker of Kirby vacuum cleaners and World Book encyclopedia, S&F was panicking. Buffett, who had owned a quarter of a million shares, dropped a message to the company asking them to call if they were interested in a merger. The phone rang almost immediately. Berkshire offered $60 per share in cold, hard, cash. When the deal was wrapped up less than a week later, Berkshire Hathaway had a new $315 million dollar cash-generating powerhouse to add to its collection. The small stream of cash that was taken out of the struggling textile mill had built one of the most powerful companies in the world. Far more impressive things were to be done in the next decade. Berkshire would see its share price climb from $2,600 to as high as $80,000 in the 1990's.

In 1986, Buffett bought a used Falcon aircraft for $850,000. As he had become increasingly recognizable, it was no longer comfortable for him to fly commercially. The idea of the luxury was hard for him to adjust to, but he loved the jet immensely. The passion for jets eventually, in part, led him to purchase Executive Jet in the 90's.

The 80's went on with Berkshire increasing in value as if on cue, the only bump in the road being the crash of 1987. Warren, who wasn't upset about the market correction, calmly checked the price of his company and went back to work. It was representative of how he viewed stocks and businesses in general. This was one of "Mr. Market's" temporary aberrations. It was quite a strong one; fully one-fourth of Berkshire's market cap was wiped out. Unfazed, Warren plowed on.

I'll Take a Coke

A year later, in 1988, he started buying up Coca-Cola stock like an addict. His old neighbor, now the President of Coca-Cola, noticed someone was loading up on shares and became concerned. After researching the transactions, he noticed the trades were being placed from the Midwest. He immediately thought of Buffett, whom he called. Warren confessed to being the culprit and requested they don't speak of it until he was legally required to disclose his holdings at the 5% threshold. Within a few months, Berkshire owned 7% of the company, or $1.02 billion dollars worth of the stock. Within three years, Buffett's Coca-Cola stock would be worth more than the entire value of Berkshire when he made the investment.

Warren Buffett's Money and Reputation On the Line During the Solomon Scandal

By 1989, Berkshire Hathaway was trading at $8,000 a share. Buffett was now, personally, worth more than $3.8 billion dollars. Within the next ten years, he would be worth ten times that amount. Before that would happen, there were much darker times ahead (read The Solomon Scandal).

Warren Buffet at the Turn of the Millennium

During the remainder of the 1990's, the stock catapulted as high as $80,000 per share. Even with this astronomical feat, as the dot-com frenzy began to take hold, Warren Buffett was accused of "losing his touch". In 1999, when Berkshire reported a net increase of 0.5% per share, several newspapers ran stories about the demise of the Oracle. Confident that the technology bubble would burst, Warren Buffett continued to do what he did best: allocate capital into great businesses that were selling below intrinsic value. His efforts did not go unrewarded. When the markets finally did come to their senses, Warren Buffett was once again a star. Berkshire's stock recovered to its previous levels after falling to around $45,000 per share, and the man from Omaha was once again seen as an investment icon.

Friday, February 10, 2012

Yesterday I publish chart which was showing similarity in movement and today I tried to find out if next day charts showing any similarity over last day chart, and found yes it shows a Head and shoulder formation during full day.

Today nifty tried repeating the same but at 11:00 AM IIP data break the rule some how and Nifty come down heavily till 5347. Expect Gap down opening on Monday with sharp movement and full of volatility the price action, I had already published

Link: expected move would turn right on Monday

Thursday, February 9, 2012

Same to Same intraday

I have observed something very interesting to share with you all or which need further research. I worked on some of my previous intraday chart and found that it has behaved in similar fashion with minute details

- Nifty consolidated till 13:30 and show sudden upmove

- The upmove was for minimum 80 to 100 points.

- All opened negative and was trading below the previous day closing

- All made double top showing weakeness

- Upmove started around 14:00 with breaking of previous day opening and moved higher

The History by default

Greece is at the center of the sovereign debt crisis that is worrying many investors and increasing the volatility of stock markets across the world. This is not a new phenomenon for that country, which has defaulted on its external debt many times since achieving independence at the beginning of the 19th century. Here are some facts that all investors should know about the history of Greek sovereign debt defaults.

Ancient DefaultThe first recorded default in Greek history occurred in the fourth century B.C., when 13 Greek city states borrowed funds from the Temple of Delos. Most of the borrowers never made good on the loans and the temple took an 80% loss on its principal.

Five TimesGreece has defaulted on its external sovereign debt obligations at least five previous times in the modern era (1826, 1843, 1860, 1894 and 1932). The first episode occurred in the early days of that country's war of independence, and the last default was during the Great Depression in the early 1930s. The combined length of period under which Greece was in default during the modern era totaled 90 years, or approximately 50% of the total period that the country has been independent. (For related reading, see Recession and Depression: They Aren't So Bad.)

Although many might consider this level of default to be excessive, Greece is nowhere even close to the top of the list. Venezuela and Ecuador, with 10 defaults each, share the (dis)honor of being the greatest serial defaulters of the modern era.

Greek War of IndependenceThe Greek War of Independence began in 1821 and targeted the end of Ottoman authority, which had ruled most of that region for centuries. In 1824, a loan of 472,000 pounds was secured on the London Stock Exchange to continue this fight. This offering was oversubscribed and buyers were required to put down only 10% of the purchase price with a promise to pay the balance over time. An additional loan of 1.1 million pounds was floated in 1825.

The unfortunate fact about these two loans was that speculators and middlemen in London skimmed off much of the proceeds before Greece received any funds. Another issue was that the Greek War of Independence soon descended into civil war between rival factions, making it difficult to even figure out who should receive these funds.

No interest payments were ever made to the bondholders on these two loans, and the value of the paper eventually plummeted to a fraction of the par value. It wasn't until 1878 that the Greek government settled on the loans, which by then with accrued interest had increased to over 10 million pounds.

Loan of 1832In 1832, another loan totaling 60 million drachmas was given to Greece, which was officially an independent sovereign nation. The loan was arranged by the French, Russian and British governments, and was ostensibly given to help Greece build its economy and manage the initial stages of governance.

The funds were mostly squandered on the maintenance of a military and the upkeep of Otto, a Bavarian prince that was made King of Greece by the English. Greece managed to stay current on this loan until 1843, at which time the government stopped payments.

The InterregnumAfter this default, Greece was shut out of international capital markets for decades. During this interregnum, the government became dependent on the National Bank of Greece for borrowing. The government's needs were modest at first but soon escalated and the National Bank of Greece provided funds at interest rates that were twice the international lending rate. (For related reading, see Get To Know The Major Central Banks.)

1893 DefaultAfter the Greek government settled outstanding defaults in 1878, the global capital markets opened once again to Greece and, as you might expect, lenders were only too eager to provide funds. This borrowing increased to unsustainable levels and the government suspended payments on external debt in 1893.

In 1898, foreign pressure led Greece to accept the creation of the International Committee for Greek Debt Management. This committee monitored the country's economic policy as well as the tax collection and management systems of Greece.

1932 DefaultIn the early 1930s, many countries defaulted on sovereign debt obligations as the world economy contracted and entered what became known as the Great Depression. Greece imposed a moratorium on paying on its outstanding foreign debt in 1932. This default lasted until 1964, the longest of any of the country's five defaults. One interesting historical anecdote is that Eleftherios Venizelos was the Greek Prime Minster that defaulted on Greece's sovereign debt in 1932.

Evangelos Venizelos, the current Greek Deputy Prime Minister and Minister of Finance, is at the center of current crisis and heavily involved with negotiations with the European Union. The two are not related, however, and there is even unsubstantiated speculation that he changed his name to Venizelos to gain political advantage. (For related reading, see The Italian Crisis.)

The Bottom Line

The history of the Greek financial system is not encouraging to those investors that are hoping that this country avoids defaulting on its sovereign debt obligations. Some may take comfort in knowing that while previous defaults were dislocating to the market, the global financial system did not suffer any long term damage because of these events.

Five TimesGreece has defaulted on its external sovereign debt obligations at least five previous times in the modern era (1826, 1843, 1860, 1894 and 1932). The first episode occurred in the early days of that country's war of independence, and the last default was during the Great Depression in the early 1930s. The combined length of period under which Greece was in default during the modern era totaled 90 years, or approximately 50% of the total period that the country has been independent. (For related reading, see Recession and Depression: They Aren't So Bad.)

Although many might consider this level of default to be excessive, Greece is nowhere even close to the top of the list. Venezuela and Ecuador, with 10 defaults each, share the (dis)honor of being the greatest serial defaulters of the modern era.

Greek War of IndependenceThe Greek War of Independence began in 1821 and targeted the end of Ottoman authority, which had ruled most of that region for centuries. In 1824, a loan of 472,000 pounds was secured on the London Stock Exchange to continue this fight. This offering was oversubscribed and buyers were required to put down only 10% of the purchase price with a promise to pay the balance over time. An additional loan of 1.1 million pounds was floated in 1825.

The unfortunate fact about these two loans was that speculators and middlemen in London skimmed off much of the proceeds before Greece received any funds. Another issue was that the Greek War of Independence soon descended into civil war between rival factions, making it difficult to even figure out who should receive these funds.

No interest payments were ever made to the bondholders on these two loans, and the value of the paper eventually plummeted to a fraction of the par value. It wasn't until 1878 that the Greek government settled on the loans, which by then with accrued interest had increased to over 10 million pounds.

Loan of 1832In 1832, another loan totaling 60 million drachmas was given to Greece, which was officially an independent sovereign nation. The loan was arranged by the French, Russian and British governments, and was ostensibly given to help Greece build its economy and manage the initial stages of governance.

The funds were mostly squandered on the maintenance of a military and the upkeep of Otto, a Bavarian prince that was made King of Greece by the English. Greece managed to stay current on this loan until 1843, at which time the government stopped payments.

The InterregnumAfter this default, Greece was shut out of international capital markets for decades. During this interregnum, the government became dependent on the National Bank of Greece for borrowing. The government's needs were modest at first but soon escalated and the National Bank of Greece provided funds at interest rates that were twice the international lending rate. (For related reading, see Get To Know The Major Central Banks.)

1893 DefaultAfter the Greek government settled outstanding defaults in 1878, the global capital markets opened once again to Greece and, as you might expect, lenders were only too eager to provide funds. This borrowing increased to unsustainable levels and the government suspended payments on external debt in 1893.

In 1898, foreign pressure led Greece to accept the creation of the International Committee for Greek Debt Management. This committee monitored the country's economic policy as well as the tax collection and management systems of Greece.

1932 DefaultIn the early 1930s, many countries defaulted on sovereign debt obligations as the world economy contracted and entered what became known as the Great Depression. Greece imposed a moratorium on paying on its outstanding foreign debt in 1932. This default lasted until 1964, the longest of any of the country's five defaults. One interesting historical anecdote is that Eleftherios Venizelos was the Greek Prime Minster that defaulted on Greece's sovereign debt in 1932.

Evangelos Venizelos, the current Greek Deputy Prime Minister and Minister of Finance, is at the center of current crisis and heavily involved with negotiations with the European Union. The two are not related, however, and there is even unsubstantiated speculation that he changed his name to Venizelos to gain political advantage. (For related reading, see The Italian Crisis.)

The Bottom Line

The history of the Greek financial system is not encouraging to those investors that are hoping that this country avoids defaulting on its sovereign debt obligations. Some may take comfort in knowing that while previous defaults were dislocating to the market, the global financial system did not suffer any long term damage because of these events.

Wednesday, February 8, 2012

Tuesday, February 7, 2012

Nifty level for Feb 8

After closing with huge gain in preceding five Tuesday, bulls want rest. This Tuesday bears are clear winner as it did not let bulls passing 5390 with confidence.

Higher volume has been noticed at higher levels with lowering Nifty. This is profit booking. But you never know when it suddenly turn bearish. After all every bull and bear run start in hourly trend change which leads to daily, weekly, monthly and so on.

Bulls may try to tighten their grip again at 5200 level.

Higher volume has been noticed at higher levels with lowering Nifty. This is profit booking. But you never know when it suddenly turn bearish. After all every bull and bear run start in hourly trend change which leads to daily, weekly, monthly and so on.

Bulls may try to tighten their grip again at 5200 level.

Monday, February 6, 2012

Nifty Monthly

I have put in here, most of the oscillators with Nifty Monthly Chart and you will come to know, why some informed trader get maximum out of market. Because they see larger picture of the market. They never get concern of hourly or weekly chart. I would still suggest to any investor, if want to earn from market, go on accumulating quality shares in small quantity and see the profit after 2-3 years. You will be surely in bull market at that time.

Saturday, February 4, 2012

Bulls are back!! yes it is!!

Earlier I publish a blog with similar title: Bulls are back!! is it true?? where in I was in doubt, cautious and looking for some more confirmation.

Today I can say, yes, bulls are back. It might prove super bull. Nifty has already closed above 5000 and above 200 SMA, i.e 5200. both are very important. physiological level and now Nifty is trading firmly beyond 5300.

If you have still any doubt, please have a look at longer term oscillator and indicators, if you believe in it

I am sure it would be an eye opening for you, and this may change your bearish view......!!

Today I can say, yes, bulls are back. It might prove super bull. Nifty has already closed above 5000 and above 200 SMA, i.e 5200. both are very important. physiological level and now Nifty is trading firmly beyond 5300.

Yes, I am still waiting for much awaited correction, which will not of that previous expected intensity, but it would be a healthy one.

If you have still any doubt, please have a look at longer term oscillator and indicators, if you believe in it

I am sure it would be an eye opening for you, and this may change your bearish view......!!

|

| Download this chart to view in bigger size |

- Longer term outlook: Fairly Bullish

- Short term outlook: Healthy correction is due for minimum 2 to 3 weeks

Good to read: S&P Reversal

Friday, February 3, 2012

Missed the train

There are times when you assume you have missed the train without realizing that it may be a long distance train…and even jumping on in middle of journey can be gratifying experience. After producing so many barriers to Bulls, Bears are now losing heart. Everyone suddenly start calling, start of new bull cycle.

Might be it is true, but this rally has proved once again that stay invested. The only and ultimate way to gain success in any market.

This rally did not gave bears a single to enter based on oscillator and indicator follower. They keep waiting to negotiate with levels and Nifty crossed time 200 SMA.

I suggest to all bears do not feel like a missed opportunity, because

Bulls make money, bears make money, and PIIGS get slaughtered

So be on one side, if you can not leave your ego.....

Might be it is true, but this rally has proved once again that stay invested. The only and ultimate way to gain success in any market.

This rally did not gave bears a single to enter based on oscillator and indicator follower. They keep waiting to negotiate with levels and Nifty crossed time 200 SMA.

I suggest to all bears do not feel like a missed opportunity, because

Bulls make money, bears make money, and PIIGS get slaughtered

So be on one side, if you can not leave your ego.....

Use Gann to Target Nifty

I am continuously finding Gann as very very important tool to target higher level of Nifty. Specially when you are not sure what should be the high or low of current rally.

It happen many a times that we know target very easily by drawing different resistance and support, based on weekly, daily, hourly or even monthly level. But there might be chances of error because we often use one or two time line to draw resistance or support.

Gann gives you advantage over normal level decider as it is free from any trend or previous performance of any level. It is free from historic trend. It never gets biased also.

I am still doing my research and found it very rewarding with low risk.

It happen many a times that we know target very easily by drawing different resistance and support, based on weekly, daily, hourly or even monthly level. But there might be chances of error because we often use one or two time line to draw resistance or support.

Gann gives you advantage over normal level decider as it is free from any trend or previous performance of any level. It is free from historic trend. It never gets biased also.

I am still doing my research and found it very rewarding with low risk.

- Decide the trend

- Set target in trend direction

- Put stoploss on lower Gann level

- Keep on improving stoploss on higher Gann level

Subscribe to:

Posts (Atom)